Developing One-stop Platform for the Early & Growth Stage Startups for Their Every Financial Needs.

Every Business is different and so their necessities are. We understand the pain points of every startups and the importance of investments at the right time. So we are simplifying the fundraising process for every startups of different stages.

We advise disruptive startups to raise funds for venture growth from Seed to Series rounds from 50+ Fund houses & 200+ Angel Investors against Equity, SAFE notes & Debentures.

We guide revenue making startups to raise venture debt for their business expansion & new vertical introduction from reputed Debt Fund houses and help them in structuring the financials and fundraising strategies.

We also advise loss making startups to raise debt fund efficiently to be profitable soon.

Absolutely efficient even powerful newly popular instrument for the E-commerce, D2C, SaaS startups generating recuring revenue to raise investments in short time. They can easily repay back the investors by sharing a minor percentage of their monthly revenue and save equity as RBF is a non dilutive finance option.

Every startup is different & so their financial necessities are. So we cater a large pool of strategic finance investors who are ready to invest understanding the startups’ business model & repayment ability to ensure a win-win situation.

Data Driven Investor Matching & Relationship Management.

Dedicated Project Manager for Process Update & Efficiency.

Experienced Consultants for Negotiation & Term sheet Analysis.

Transaction Advisory & Post Investment Support.

60% of our Portfolio Startups have received at least one term sheet from Angel Networks/ VCs or Fund houses.

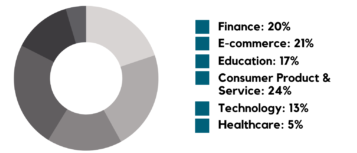

Latest Equity Investment Scenario Across Different Sectors in India in FY 21-22.

Startups have experienced 250% revenue growth and saved an average of 12.5% ownership with non dilutive finance options.

Develop Sustainable Startup & Kickstart With Startup India Seed Fund.

Develop Your Startup from Scratch with Us.

Raise Up-to ₹30 Lacs Unsecured Debt.

Get Documentation & Hand holding Support.

News & Articles.

Business Crisis & Driving Risk Factors | Crisis Management [ Chapter I ]

How you can raise collateral free loan up to ₹2.0 Cr. with CGTMSE?

RBI Raised Repo Rate by 40 Basis Points – Impact On MSMEs & Lending Industry

What founders should understand while raising Startup India Loan?

Connect With Our Consultants.

Debmallya Marik | MD, Buzzmentr.

Advising Startups & SMBs across India & guiding them in product development, product-market fit, developing synergies and raising investments. He is connected with many reputed institutes like IIT-M, IIT-G, IIT-K & IIMs.

Adhiraj Goswami | ED, Buzzmentr.

Seasoned Investment Advisor for reputed businesses and NBFCs & MFIs. Empowering data driven decision making in investment industry & leading strategic investment domain at Buzzmentr.

Latest News & Events

A Clean Website Gives More Experience

Work with Us →

Partner With Us →

© copyright © 2023 | Buzzmentr Innovation Network Pvt. Ltd.