Developing All Weather MSME Finance Platform for the Early & Growth Stage SMBs.

Enabling the power of finance for every business of different size across industries. We facilitate Project Finance to Structured Investments ensuring better terms and lesser turn-around time.

We advise small & medium scale enterprises raises secured debt for different purpose like venture expansion, working capital necessities at industry best interest rate starts from 8.50% interest rate per annum.

We guide growing msmes raising unsecured growth capital from Lending Institutes & Fund-houses with flexible repayment tenure and repayment terms to unleash the potential of their business brilliance.

Being a growing economy India brings lots of opportunities for entrepreneurs and visionaries. We advice organizations and experienced professionals in structuring asset based businesses and raising project finance from Lending Institutes, Alternative Investment Funds, Industrial Banks & Private Investors.

Every business is different & so their financial necessities are too. So we cater a large pool of strategic finance investors who are ready to invest understanding the business model & repayment ability to ensure a win-win situation.

Every industry has its own specific investment requirements, return capacity and turn around time. So we have introduced industry specific debt products for Manufacturing, Infrastructure, Healthcare, Education, IT & Internet, Power & Ex-Im sector understanding the requirements of the clients.

Secured Debt & Working Capital Solutions.

Green Field Project Finance Solutions.

Structured Debt for Real-estate & Infra Projects.

SMB Loan Against Invoice, GST-R, Workorders.

Equipment Finance, Purchase & Vendor Finance.

Structured Debt for Hospitals & Healthcare Co.

Want Structured Loan with Flexible Repayment Terms & Tenure?

Data Driven Decision Making Approach for Deal Structuring.

Raise Funds in Lesser Time with Better Project Value, Every time.

Experienced Consultants for Negotiation & Term sheet Analysis.

Transaction Advisory & Post Investment Support.

Buzzmentr has proved its strategic efficiency of 72% in the domain of msme financial advisory in FY 21-22.

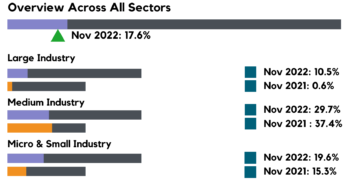

Sectorial Deployment of Bank Credit [ Y-O-Y Growth] Nov 2022 vs Nov 2021.

28,684 micro enterprises and 3,679 small businesses have grown into small and medium-sized businesses respectively from inception till March 22, 2022.

Get Collateral Free Loan Up to ₹ 2.0 Cr. with CGT-MSE Scheme.

35+ Banks & NBFC Lending Partners Investing.

₹35,033 Cr. Loan Approved for New Ventures- Retail & Hybrid.*

News & Articles.

Business Crisis & Driving Risk Factors | Crisis Management [ Chapter I ]

How you can raise collateral free loan up to ₹2.0 Cr. with CGTMSE?

RBI Raised Repo Rate by 40 Basis Points – Impact On MSMEs & Lending Industry

What founders should understand while raising Startup India Loan?

Connect With Our Consultants.

Debmallya Marik | MD, Buzzmentr.

Advising Startups & SMBs across India & guiding them in product development, product-market fit, developing synergies and raising investments. He is connected with many reputed institutes like IIT-M, IIT-G, IIT-K & IIMs.

Adhiraj Goswami | ED, Buzzmentr.

Seasoned Investment Advisor for reputed businesses and NBFCs & MFIs. Empowering data driven decision making in investment industry & leading strategic investment domain at Buzzmentr.

Latest News & Events

A Clean Website Gives More Experience

Work with Us →

Partner With Us →

© copyright © 2023 | Buzzmentr Innovation Network Pvt. Ltd.